Cyber insurance is evolving. Insurers are moving beyond reactive policies to service-driven models, including MDR, patching tools, continuous risk monitoring, AI-driven insights, and cyber risk modeling.

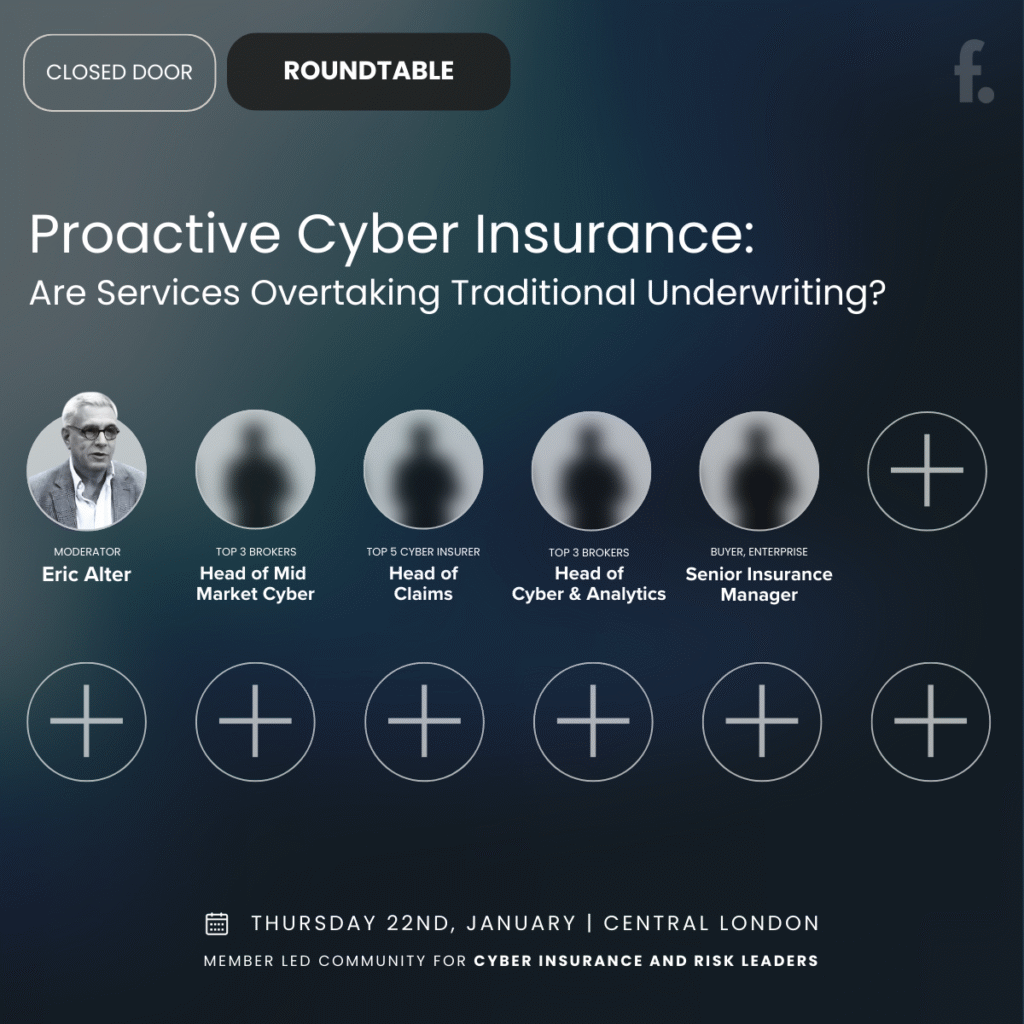

This closed-door roundtable explores current challenges shaping the market:

- Are proactive services becoming as important as the policy itself?

- How are cyber modeling and continuous monitoring reshaping underwriting and pricing?

- Which adoption barriers are keeping SMEs from fully leveraging proactive services, and how can insurers and vendors close the protection gap?

- Should insurers act as de facto MSSPs, or is there a limit to their operational involvement in mitigating large-scale cyber threats?

This executive roundtable debates the evolving role of services versus policies, and surface practical strategies for managing adoption, pricing, and systemic cyber risk in 2026.